In Chinese astrology, the Year of the Dragon is considered to be an auspicious and powerful time. People born in the Year of the Dragon are believed to inherit some of the dragon’s characteristics, such as being confident, ambitious, and charismatic. The Dragon is also associated with good luck, prosperity, and success.

Many people believe that these individuals will have a strong and dynamic personality, as well as good fortune throughout their lives. Thus, many believed it is generally considered fortunate if your child is a Dragon baby. It’s important to note that while cultural beliefs and traditions can be interesting and fun to consider, they should not be the sole basis for important life decisions. Factors such as health, well-being, and individual personality should also be taken into account when making decisions about family planning or celebrating significant life events.

Regardless how much truth is in this belief, the year 2024 is indeed a good year if you are considering adding a new member to your family from a financial planning point of view for a few reasons.

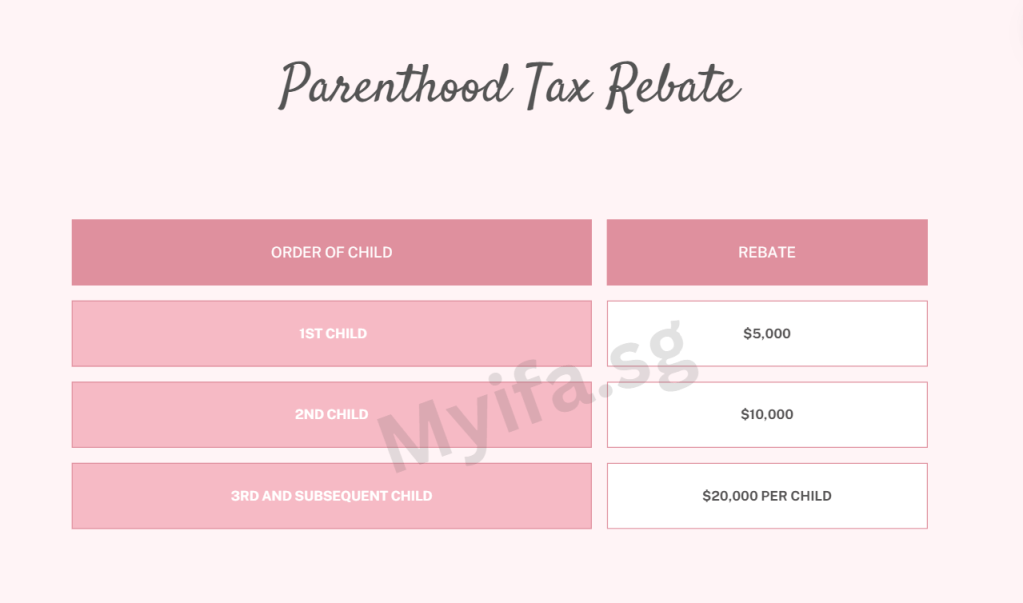

1) Parenthood Tax Rebate

If you are a parent, you may be eligible to claim the Parenthood Tax Rebate .The child must be a Singapore Citizen at the time of birth or within 12 months thereafter. You may share the Parenthood Tax Rebate with your spouse for each qualifying child to offset your respective income tax payable. Any unutilised Parenthood Tax Rebate can be used to offset your income tax payable in subsequent years until the tax rebate is fully utilised.

2) Qualifying Child Relief/Handicapped Child Relief

You may also share the Qualifying Child Relief or Handicapped Child Relief on the same child with your spouse based on an agreed apportionment.

3) Working Mother’s Child Relief

If you are a working mother who is married, divorced, or widowed, and you have a child who is a Singapore Citizen, you may claim the Working Mother’s Child Relief.

The total amount of Qualifying Child Relief/Handicapped Child Relief and Working Mother’s Child Relief claimable for each child is capped at $50,000.

4) Grandparent Caregiver Relief

If you are a working mother whose parent, parent-in-law, grandparent or grandparent-in-law is looking after any of your Singapore Citizen children aged 12 years and below* in the previous year, you may be eligible to claim the Grandparent Caregiver Relief of $3,000.

5) Foreign Domestic Worker Levy Tax Relief

Foreign Domestic Worker Levy Tax Relief may be claimable by a woman who is married ,divorced or widowed with children who are aged below 16 or studying full-time at any educational institution.

You may claim twice the total foreign domestic worker levy paid in the previous year on one foreign domestic worker.

6) Baby Bonus Scheme for 2024

Enhanced Baby Bonus Scheme for eligible Singaporean children born on or after Feb 14, 2023.

7) Paternity Leaves

Daddy, you are not left out, paternity leave will increase from two weeks to four weeks for eligible working fathers of Singaporean children born from Jan 1, 2024.

8) Unpaid Infant Care Leave

All parents of Singaporean children who have worked with their employer for a continuous period of at least three months will be eligible for 6 days unpaid infant care leave currently.

With effect from 1st Jan 2004, each parent will receive 12 days of unpaid infant care leave per year for the first two years of their child’s life.

We had invited 2 esteemed doctors to share the journey of pregnancy with you. Join us for this webinar.

In the event that you are reading this post after the webinar, do drop us an message if you have any questions on the topics or maternity insurance.

Scan to send us a WhatsApp message