Life insurance participating funds play a crucial role in the insurance landscape of Singapore, providing policyholders with a unique opportunity to participate in the financial success of their insurance company. These funds, also known as with-profits or par funds, offer policyholders the potential for bonuses and dividends, making them an attractive option for those seeking a combination of protection and investment growth. In this article, we will look how the returns had performed for the different insurers in Singapore.

Life insurance companies invest the premiums collected from policyholders in a diversified portfolio of assets such as stocks, bonds, and real estate. The returns generated from these investments contribute to the overall performance of the participating funds. The insurer aims to achieve consistent and stable investment returns from the participating funds to support the payment of bonuses to policyholders.

Participating funds are investment portfolios managed by life insurance companies. Policyholders who opt for participating life insurance policies become entitled to a share of the profits generated by these funds. The profits are typically in the form of bonuses, which can include reversionary bonuses and terminal bonuses. Under the allocation rule by the MAS, shareholders can receive up to 10% share of the profits distributable from the participating fund, while the rest are allocated to policyholders. In another words, the policyholders are entitled to 90% of the participating funds profit.

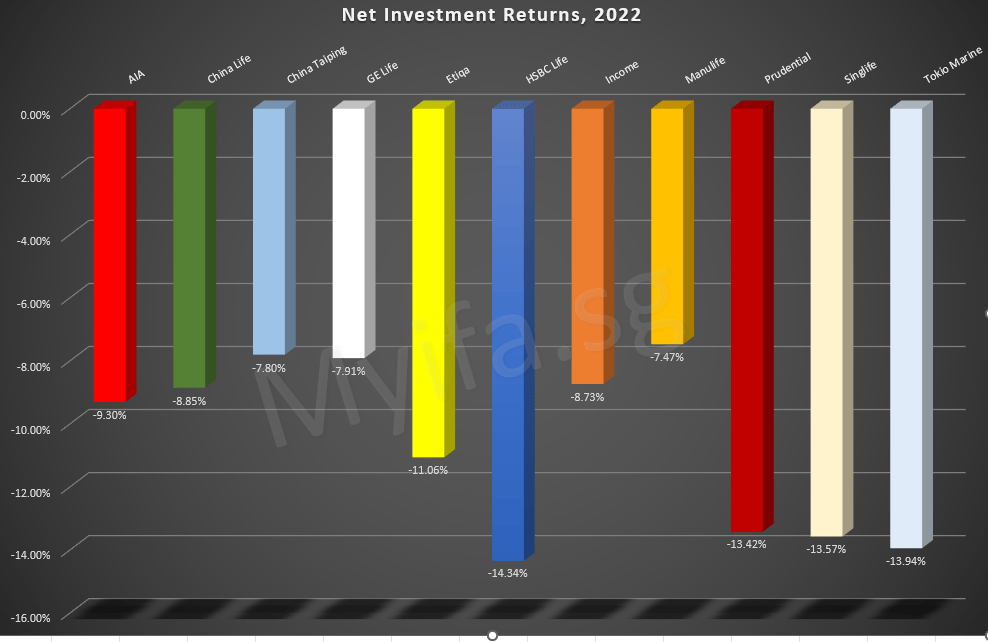

Below shows the performance of respective insurer’s participating fund returns after expenses.

We can see that all the returns are negative and looking at the chart below that shows the various indices performance in 2022. Considering the average indices performance is about -15%, the performance of the insurers par funds are still acceptable.

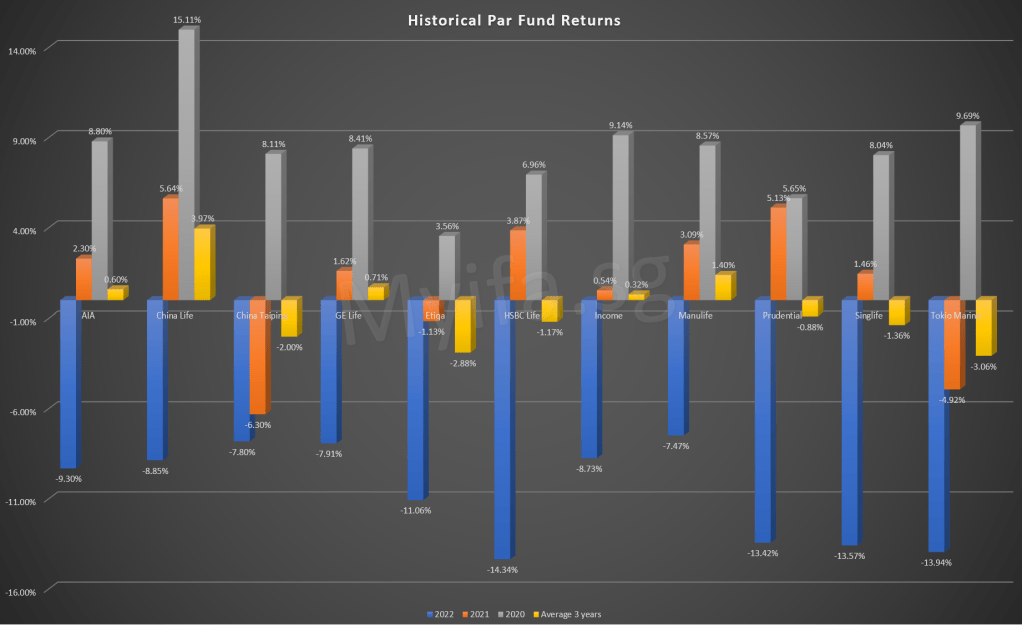

Now, you might be thinking, how can insurance companies pay the policy holders bonuses if they have negative returns? The answer to this will be the “smoothing of bonuses” policy. The smoothing policy refers to holding back a portion of bonuses in years where the fund has achieved good performance so that bonuses can be maintained during years of poor performance.

An insurer may pay an average of 2.5% to 3.5% annualised return to a participating policy, depending on policy type and term. When an insurer smooths the bonus, it will keep the excess performance to pay off when the par fund is under-performing. For the purpose of discussion, we shall use China Life as an example. In 2020, China Life had a very good performance at 15.11%. For simplicity, we assume China Life pays 3% in total to its policy holders. This means the excess of 12.11% will be transferred to the par fund reserves and it works the same for the excess in 2021. Since there is a negative returns in 2022, the insurer will used the money that were accumulated in par reserves fund to pay off the bonuses. Thus, bonuses may not necessarily follow the short-term movements in the investment markets because of smoothing of bonus.

What is your views on the “smoothing of bonuses” policy? We look forward to your comments.