In the recent weeks, we had read about the changes in integrated shield plans(IPs), increase in premiums and more importantly, the inclusion of Panel and Non-panel specialist. First of all, the concept of panel and non-panel medical services is not new an it is a common practice in business insurance such as Employee Benefits. The insurance company a panel of doctors or specialist to be their preferred choice of medical professionals for a few reasons and mainly, it is for ease of administration as well as cost control. Insurance companies may allow its policy holders to seek medical treatment outside of their panel of medical professionals(non-panel) but different insurers may treat such consultation. Insurance companies may impose a limit on claims, charge extra premiums or even reject the claims. However, in the recent weeks, we had seen Singapore Medical Association(SMA) and insurers pointing fingers at each other on IPs. Before we look at the face-off between the two, let me share a little history of IPs.

In a nut-shell, Aviva enters the IP market with a BOOM! Not only did Aviva launched the first “As-charged” IP, they also had mortarium underwriting. I must say Aviva took the market by storm and sent the rest of the IP insurers a wakeup call to review their plans. However, there was someone who was against “As-charged”. It is interesting to note that while everyone was exciting over it, Mr. Tan Kin Lian actually said –

A insurer has introduced a hospital plan that pays the bills “as charged”.…

This plan is likely to lead to an escalation in hospital bills. The private hospital and doctors will increase the charges to the patient who is covered under this plan, as the insurer has deep pockets. This will lead to an increase in premium rates for the “as charged” plan. Experience in other countries have shown that this type of plan has the highest escalation in premiums.

On the hindsight, I wished more shared that view and “As-charged” plan did not take place. Fast forward to today, we all know the premium in every IP had increased over the years. One obvious reason is medical advancement. For example, a cancer treatment will require radiotherapy which we know is damaging to the patient as it kills the friendly cells too. With medical advancement, we can kill the cancerous cells using proton beam therapy. This treatment is less invasive because we can pinpoint to the cancerous cells without damaging the friendly cells nearby. The cost of a proton beam therapy could be as much as 3 times as the convention treatment. Prior to the current exchange between SMA and insurers, there were other issues such as clients having buffet syndrome, over-treatment from medical professionals and so on. There were suggestions that premium increased was due to profiteering from insurance companies and financial adviser representatives(FAR) getting paid too much for their commission. I had written an article on that a few months ago.

I am not denying that cutting distribution cost will reduce premium in some ways but today, I will go a bit more in-depth into what might be the main cause instead on focusing on distribution cost. I am using the treatment of Heart surgery with coronary artery bypass as a case study because this is a common cardiovascular condition and the treatment has not change much over the years other than having an open-heart surgery or less invasive keyhole surgery. For discussion purpose, I will focus on Open-heart surgery which is a cheaper treatment. In 2012, the cost of Heart surgery with Coronary artery bypass graft is as follow

| Hospital | Ward Type | Ave LOS | 50% Bill Size | 90% Bill size |

| National Health Center | A | 8 | $ 28,124 | $ 33,010 |

| Mt. Elizabeth Hospital | 1 bedded | 8.3 | $ 43,688 | $ 71,238 |

Let’s look at the cost of the same treatment today.

Source: Mt. Elizabeth Hospital

The cost at 50% percentile is almost $18,000 more than what might be the high side of the treatment cost in 2012. Even at today’s 75% percentile, it cost about $30,000 more. That is a 25% and 50% increase in cost respectively and we are not looking at the 90% percentile yet…To be fair, the average fee for the treatment across private hospitals is around that range.

I had mentioned in my previous article that the basic premium for a 45 male had increased from $446 in 2010 to $714 in 2020 and that’s an increased of $268. The distribution cost for an IP had remained the same since day one at about 20% which goes into management cost such as marketing the plan, processing a claim etc and paying of commission In fact, similar to recommended fees benchmark by MOH for the doctors, MOH and MAS had put a cap on the maximum distribution cost for IP as well as other insurance plans. Assuming the FAR gets the full 20% and the rest are profits to insurers, it means that the FAR gets $89.20 and the insurer gets $356.80 in 2010 and in 2020, it will be $142.80 and $571.20 respectively. To put this in perspective, think of yourself as an employee, you get paid $89.20 in 2010 and your salary increase to $142 over a period of 10 years.

The most recent change in IP saw benefits increased after 1st April 2021. I have no intention to promote any insurers so I am leaving out the company’s name and I will call it as Insurer A. This particular insurer enhanced its plan to include the following

- Cell, tissues and gene therapy to cover outpatient treatment/day surgery up to $250,000

- Proton beam therapy up to $100,000

- Impatient palliative care service – As charged

- Hemi-body radiotherapy – As charged

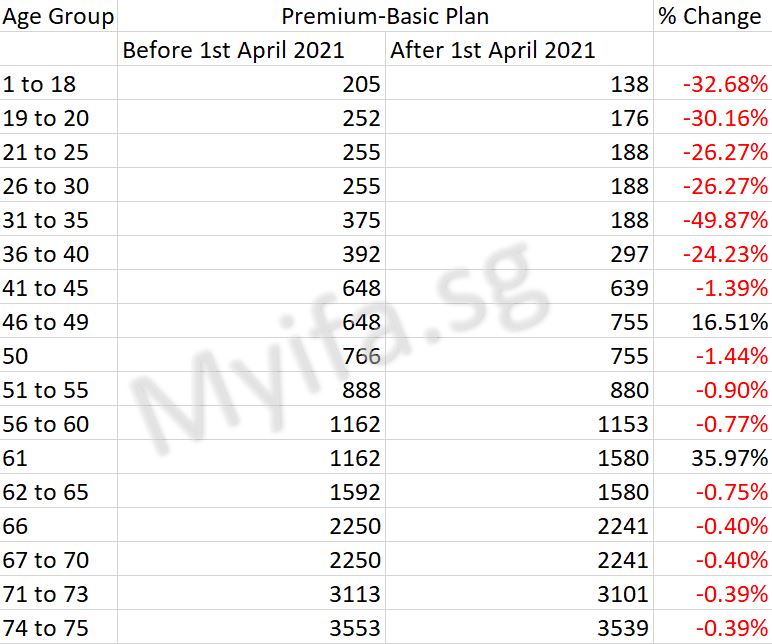

Speaking of profiteering, we would expect this insurer to give a bit of enhancement and increase the premium. The revised premium is shown below and there is no change in the premium for its rider.

The following table show the breakdown of premiums collected and where the money goes. Non-claim related expenses is not just agent’s commission. It includes

- the man-hour cost of the underwriter who accepts or rejects one’s application

- the man-hour cost customer service officer who liaise with the medical professional for the pre-authorisation letter

- the man-hour cost of the claim officer who liaise with CPF Medishield Life and Medical institution to process your claims

Of course, some may say lower these expenses and the premium will be lowered. We do not expect medical professionals to waive their professional fees unless they are in a non-governmental organization (NGO). Neither do we expect insurance companies nor agents to provide an IP without any profit unless they are a charity organisation. Again, I am not disputing the fact that commission and other non-claim related expenses affects the overall cost but how significant are these as compared to the claims?

Excellent post. I definitely love this site. Thanks!

LikeLike

Way cool! Some very valid points! I appreciate you penning this article and the rest of the site is really good.

LikeLike