The Life Insurance Association (LIA) has announced its first major update to the CI Framework since 2019. These changes, known as the LIA Critical Illness Framework 2024, will officially take effect on 1st October 2025. The review and update of these definitions is done every three years to make sure our insurance coverage keeps pace with modern medicine and provides even clearer protection.

Think of the LIA CI Framework as the official rulebook for critical illness insurance in Singapore. It provides standardized, industry-wide definitions for 37 severe-stage critical illnesses. This means whether we buy a policy from Insurer A or Insurer B, the definition for a condition like “Major Cancer” or “Stroke” will be exactly the same. This consistency makes it easier for consumers to compare policies and ensures fair and predictable claims outcomes for everyone. It’s important to note that these definitions only applies to the severe stage of these 37 conditions. Insurers still have the flexibility to provide their own definitions for early or intermediate stages of an illness.

With standardized and updated definitions, we get several key benefits:

- Clarity & Confidence: We can compare different CI policies easier, knowing the core coverage for severe conditions is identical.

- Fairer Claims: Standardized definitions reduce ambiguity and disputes during claims, as all insurers must use the same medical definition.

- Modern Coverage: The definitions are aligned with current medical treatments, so we are covered for current procedures, not just outdated ones.

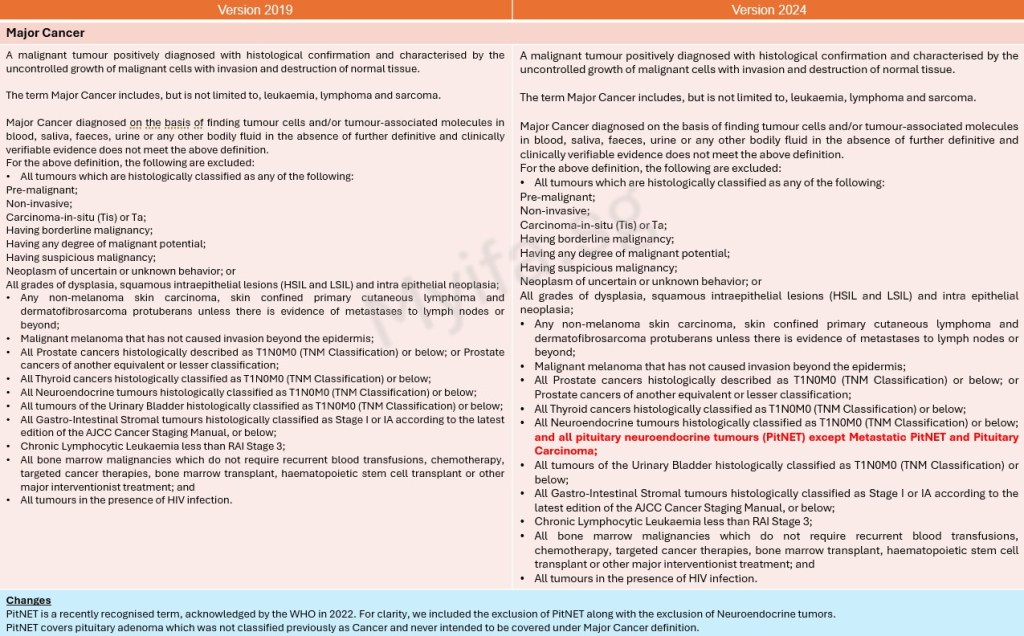

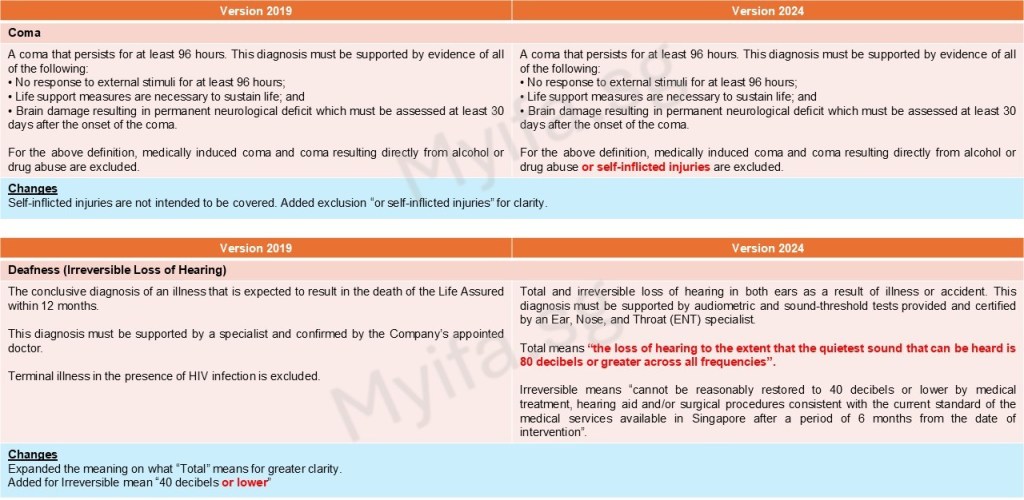

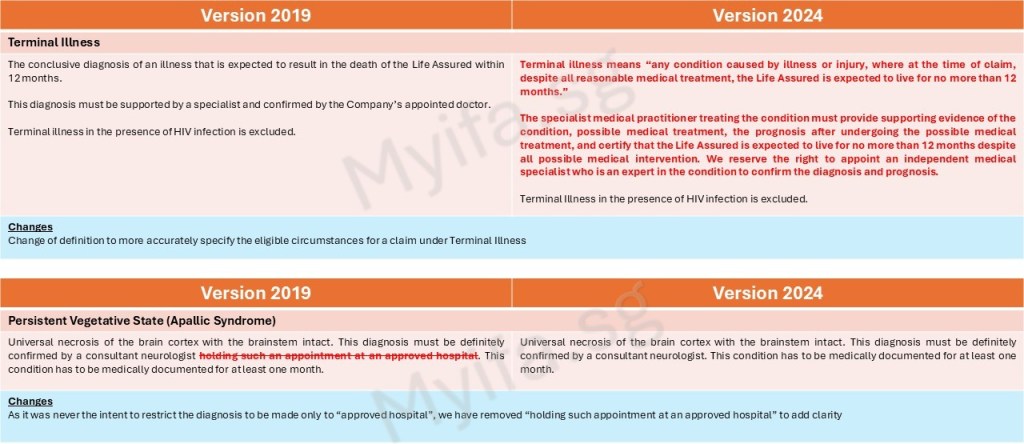

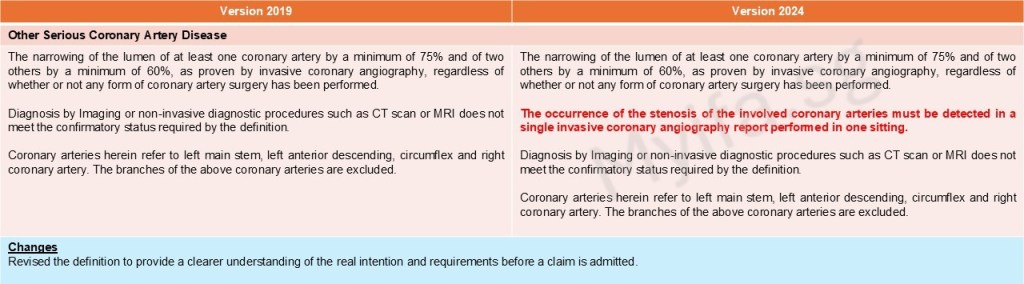

Here’s a quick summary of the changes:

- 7 critical illness definitions have been updated to reflect medical advances.

- 2 condition names (headers) have been reworded for better clarity.

- 30 definitions remain unchanged, providing stability for most conditions.

One examples of this update is the change from “Open Chest Surgery to Aorta” to simply “Surgery to Aorta.” The 2019 definition specified that the surgery had to be “open chest,” a highly invasive procedure. Today, many of these surgeries can be performed using minimally invasive “keyhole” techniques. Under the older definition, such claims could be denied since they did not meet the “open chest” requirement. To align with modern techniques, the 2024 framework redefines the condition as “Surgery to Aorta,” ensuring coverage applies to both open and minimally invasive approaches. This update ensures coverage applies regardless of the surgical method, protecting us against advancements in medical practice.

If we have an existing policy, Don’t worry! Our current coverage is still valid and will follow the definitions (e.g., Version 2019) that were in effect when we bought it. In fact, most insurers will follow the latest definition if it is “better”.

Do note if we are buying a new policy and wish to be covered under the 2019 Framework, the proposal must be signed by 30th September 30 2025 and the policy is issued by December 31, 2025.

Below are the details of the changes to the header and definition.

Always check with our insurer or financial adviser representative if we are unsure which version of the framework applies to our plan.

Medical science doesn’t stand still, and neither should our insurance. Just like how LIA reviews and update the definitions every three years, we need to review our critical illness coverage regularly. The review is not only to be updated with the latest definition, it is also to ensure the critical illness benefits are align to our current financial needs and earnings.