In today’s dynamic and ever-changing economic landscape, job security is a growing concern for many individuals. The fear of unexpected job loss due to various factors such as economic downturns, technological advancements, or corporate restructuring has led to an increased interest in financial instruments that provide a safety net during challenging times.

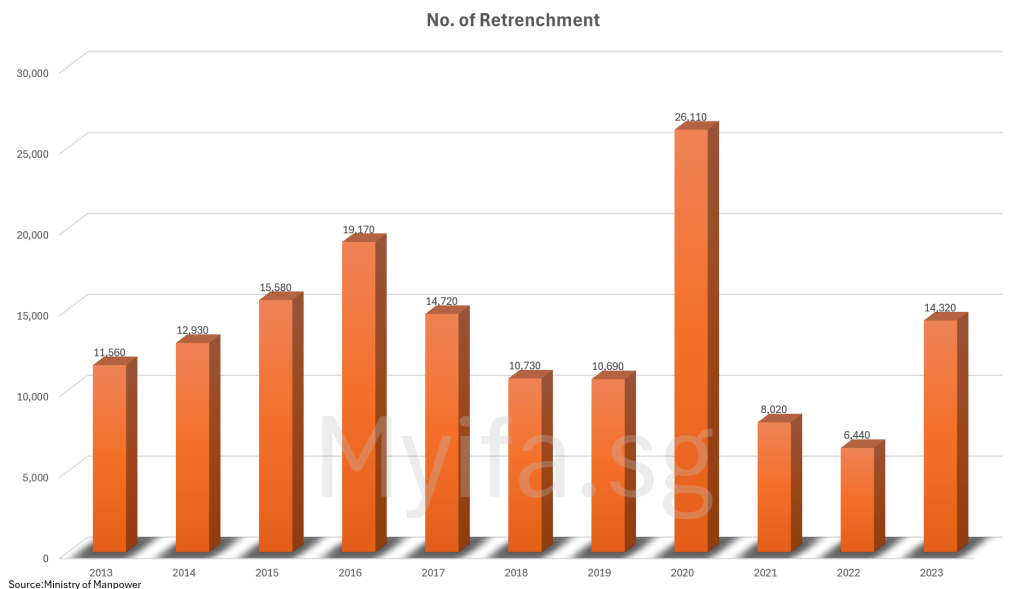

Singapore, renowned for its economic resilience and stability, has not been immune to the global uncertainties that can impact the job market. As the world experiences economic fluctuations, Singaporeans, too, have faced challenges, including the unfortunate circumstance of retrenchment. The chart below shows the number of retrenchments over the past decade.

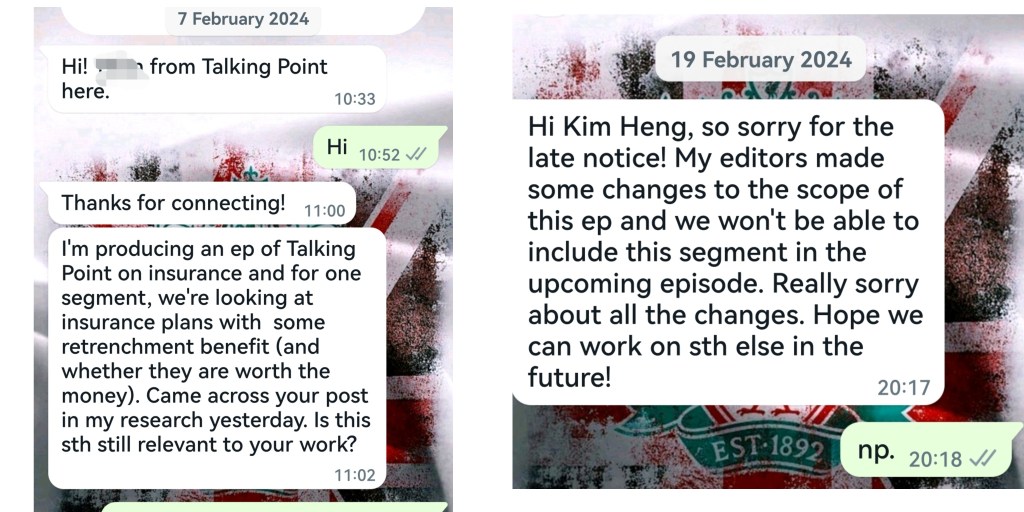

It is clear that retrenchment is on the raise. We are into the 1st Quarter of 2024 and the Tech industry alone has 32,000 layoffs. That’s probably the reason we are seeing more articles on retrenchment related matters. An Executive Producer(EP) from Talking Point happened to see one of my article on retrenchment insurance that was written a few years back and asked if I can speak on the topic. It was supposed to go ahead but was cancelled at the last minute.

I had, however, written some information on the topic and had sent it to the EP. I thought I might as well not waste it and share the information here. Retrenchment insurance was available in 2004 but taken off the shelf more than 10 years ago due to low take up rate of the plan. The good news is retrenchment benefit is a common benefit automatically included in many insurance policies these days. The criteria to qualify for the unemployment benefit are usually quite similar.

- The policy must be in force for a minimum period . This period can varies from as short as 90 days to 2 years.

- The Policy holder is below 65 years of age

- The unemployment period is at least 30 days

The documents needed for a claim are usually the retrenchment letter from company and last 12 months of CPF Statement.

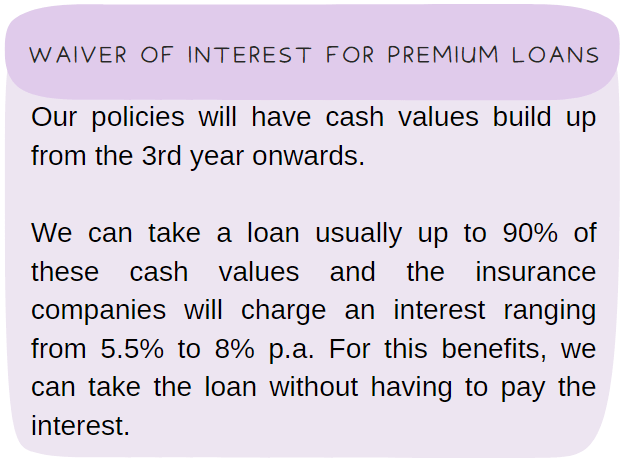

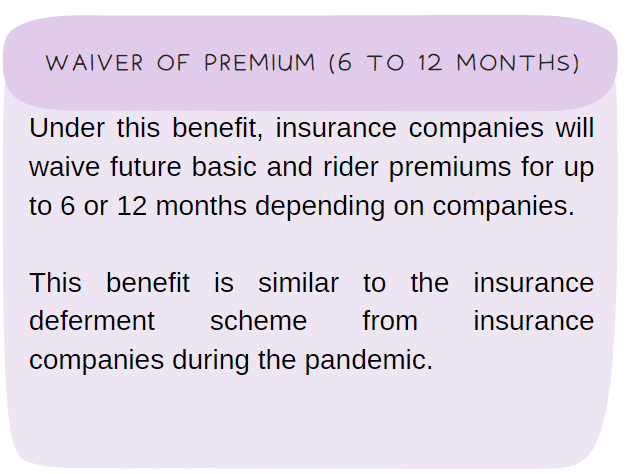

The benefits may differ across companies. We can broadly classified the benefits into 3 different types as below.

While these retrenchment or unemployment benefits are good to have, the better way to manage this risk is to self-insure. We can do so by setting aside an emergency fund. In my next article, we shall look at how much is needed and what needs to be included for this buffer.