The school holidays are here again, and working adults are clearing their annual leave. That means the holiday season is around the corner, and after spending so much on your trip, the last thing you want to skimp on is your travel insurance. However, not all travel insurance plans are the same. While each of us has different factors to consider when purchasing travel insurance, here are 5 factors to consider.

1. Family or Single plans

Most families will purchase a family plan if they are traveling with young children, as it is less hassle and cheaper. Insurers usually define a child as anyone below 21 years old, however, a child who is 16 and above can purchase their own travel insurance.

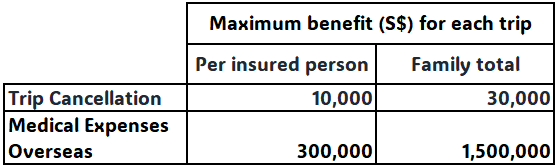

Let’s take a look at the table below. It shows the benefits for Trip Cancellation and Overseas Medical Expenses, which are common benefits in a travel insurance plan.

In a travel insurance plan, we have an individual limit and a family limit. Using Trip cancellation as an example, what will be the differences in claims assuming the claim per person is $12,000? Let’s have a mini case study for a family of 4 – Husband, Wife, Son age 18 & Daughter age 20. If they had bought an individual plan each, the maximum payout they receive per person will be $10,000. So, as a family unit, the non-claim will be a total of $8,000. If they had bought a family plan, the max payout will be $30,000, which is the family limit. That means $18,000 is not claimable.

The same goes for other benefits with family limits, so be careful with the limits.

2. Pre-existing medical conditions

Those with pre-existing medical conditions may be more prone to falling sick when we travel overseas. It could be due to a weaker immune system, difficulty in adapting to different climate, air conditions or other reasons.

An Asthmatic or a person with cardio-vascular conditions may suffer an attack due to the bad air conditions abroad or the stress from travelling. If you have pre-existing medical conditions, you may want to consider purchasing a travel insurance that covers these conditions, else, it may mean benefits such as trip cancellation, medical expenses etc due to these conditions will be excluded.

There are 3 companies that offers travel insurance plans with coverage for pre-existing conditions. There are Etiqa, MSIG and Income.

3. Hazardous activities

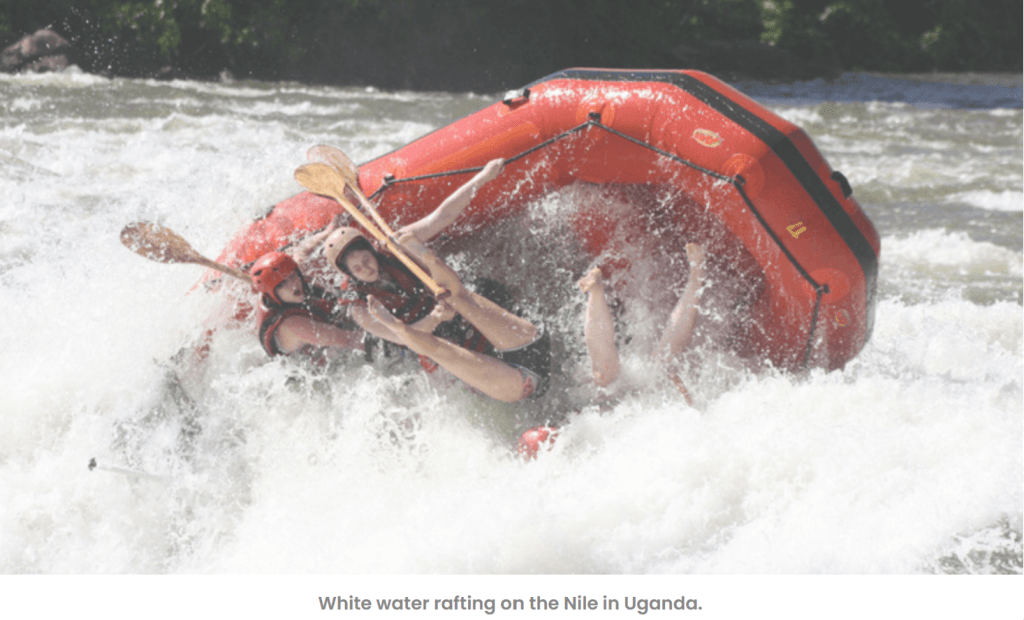

A travel insurance covers mainly leisure activities. In case there are high risk activities in your itinerary, you may want to pay attention to the exclusion. Typically, these are the common excluded activities.

- Any paid form of professional competitions or sports, in which you are sponsored or receive any kind of monetary reward

- Canoeing or white water rafting without a qualified guide or Grade 4 and above (of the International Scale of River Difficulty)

- Drag racing

- Expeditions to remote, previously undiscovered or inaccessible locations

- Off-piste skiing, or skiing outside the officially approved boundaries of a ski resort

- Piloting an aircraft without a licensed guide

- Scuba diving unaccompanied below 30 metres

- Trekking above 3,500m

Do highlight to your financial adviser representative if you are having activities that are hazardous so they can confirm if it’s covered.

4. Additional benefits

The basic benefits for travel insurance are similar across all insurers but there maybe additional benefits that covers specific events or country. For e.g. if you are hiring a vehicle oversea, most travel insurance plans will provide benefit for the car excess but Sompo also cover against loss or damage to tyres. Sompo also provides cashless outpatient service while travelling in Japan!

Do note that there are a handful of insurer that do not include COVID-19 as a covered event or you may have to pay extra to cover it. Good news is COVID-19 is a covered event by most insurers.

5. Discounts!

My advice is don’t look at price to decide which travel insurance to buy but as a matter a fact, price is a concern for many consumer when it comes to a decision to purchase. As an Independent Financial Adviser Rep, we get various discount and promotions from insurers at different time of the year especially now when its the holiday seasons.

A word of caution – It does not mean the premium on a 40% discount is cheaper than one with only 35% discount. Similarly, it does not mean the more expensive plan has better benefits with a cheaper plan.

Always talk to a Financial Adviser Representative if you need any clarification.