Let’s say you are shopping around for a fire insurance and there are two quotes for you to choose. One is $300 and the other is $700, which will you choose? The answer is quite obvious and we are likely to take the $300 but read on to see if that is the better choice or you should choose one that is more expensive.

I got a renewal quote on Fire insurance and the client asked if I can match the premium. When I saw the benefits and premium, I know I can either offer to take over as the servicing agent or just lose the case because the premium is so low. It was below $400! Nevertheless, I source around and the next lowest quote was $700. I decided to look deeper to the big difference in premiums!

In general insurance, “Excess” is a common term. An “excess” is the agreed amount of money you will pay towards a claim. Once the excess is settled, the insurance provider will then pay the remaining amount up to the limit of cover. For e.g. if a policy excess is $1,000 and a claim of $10,000 is made, the insurance company will pay $9,000 only.

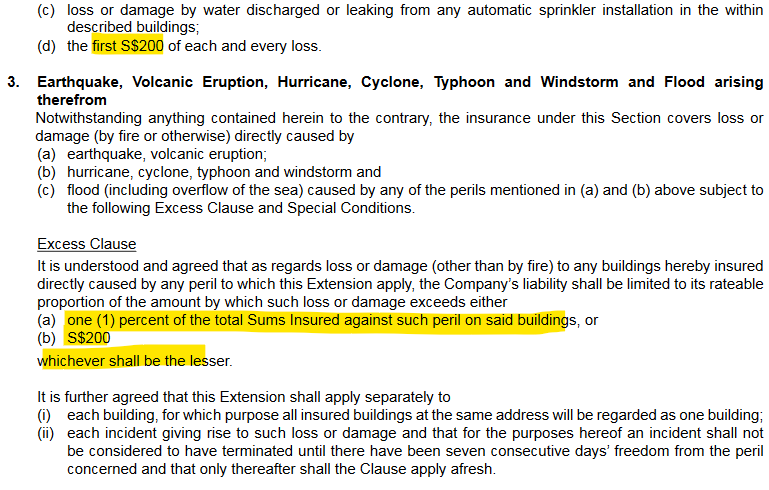

The following is the excess on the $300 policy.

The following is the excess on the $700 policy.

Back to the question again, did you have the same answer as before?

Every often, insurance agents get a renewal notice and the client says . ” find me something cheaper”. Sometimes, everything is the same except for one line, one word or one number. I remember a case when I was still a newbie 20 years ago when I started the business. One client of mine who owns an aquarium was concern about his fishes dying if there was a electrical black out. A competitor showed him a shop insurance for $200 plus and mine was $600 plus. I was surprised and I told my client to show me that policy because if the rate is so good, I will recommend that to my other clients. I read thru the policy wordings and both policies were the same except the hours of blackout. The $600 plus policy had a excess of 8 hours and the $200 plus policy was 12 hours. My point to him was he can get the $200 plus policy if he just want to feel safe but logically, 8 hours comes before 12 hours. We are talking about the ‘ease of claim’ here. Next, we are in Singapore. I can’t say about other countries but blackout is almost unheard of and even if it happens, I think the worst was like 2 hours back then? Do we expect a 12 hours blackout in Singapore? We are talking about the ‘probability of claim’ here.

The purpose of this post is not to suggest which insurer is better nor to suggest expensive is always better. It is dangerous to compare base on price and I strongly suggest going into the details.