In the world of insurance, honesty isn’t just a moral virtue, it is the fundamental of the insurance contract. A recent case involving a Singaporean man who fell to his death in Australia serves as a sobering reminder of what happens when that fundamental is compromised.

A Singaporean man took up 12 life insurance policies within a short period, with a total coverage of about S$6.9 million, despite earning only around S$75,000 a year. Two years later, he tragically died after falling from the 33rd floor of a building in Australia. The coroner ruled his death accidental.

His widow subsequently filed claims on the policies. However, the High Court ruled that the insurer was entitled to void one of the policies, and the claim was dismissed.

Many people asked me, “How can the insurer refuse to pay when all the premiums were paid?”

The court’s answer was clear: the policy was void due to fraudulent non-disclosure and misrepresentation. Let’s break down what happened and what every policyholder should learn from this.

First, let’s be clear, we cannot put a price on a human life. However, in financial planning, the economic value of a person’s life is typically measured by their ability to earn income, support dependents, and contribute financially.

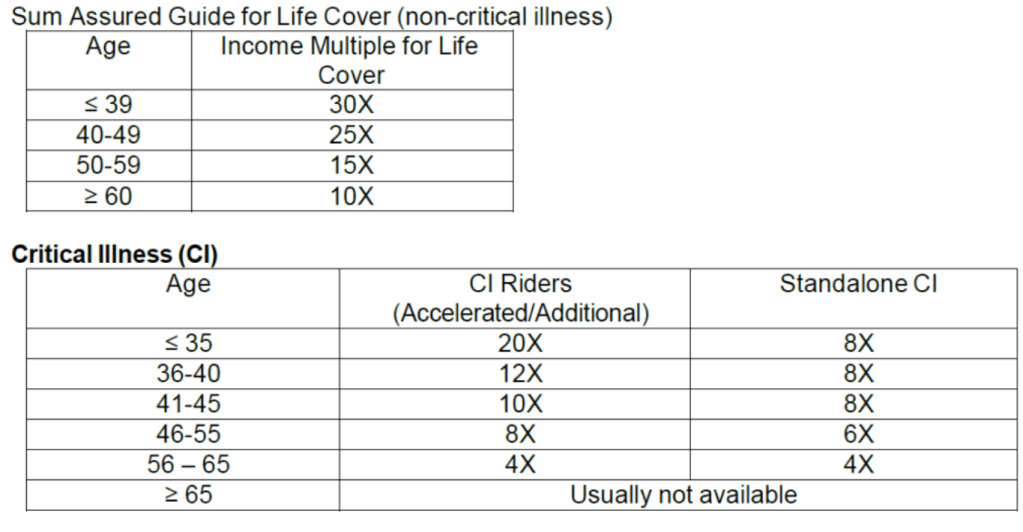

This concept is widely used in financial planning and compensation frameworks such as WICA. In fact, MAS released a Basic Financial Planning Guide in 2023 recommending suitable coverage ranges for individuals. The reality is some people may genuinely need more coverage due to family responsibilities. That’s why insurers use financial underwriting guidelines to determine the maximum amount of insurance a person can reasonably buy based on income and financial profile.

For e.g. The following guide is from an insurer in Singapore.

There are different limits depending on the benefits and age of the individual.

Each insurer has its own limits, depending on:

- Age

- Type of benefit

- Income level

- Existing insurance coverage

On top of that, insurers also consider:

- Health conditions

- Occupation risks

- Lifestyle factors

- Existing policies and pending applications

All these are known as material information.

A simple analogy – if you’re selling a car and someone offers you S$100,000, the value would likely drop if you disclose that the car had been in a serious accident before. That accident history is material information because it affects the buyer’s decision and the re-sell value of the car.

Insurance works the same way.

Non-disclosure happens when an applicant fails to reveal material information that would affect the insurer’s assessment of risk.

In insurance law, applicants are under a duty of utmost good faith. This means you must voluntarily disclose all relevant facts, even if you are not specifically asked.

In this case, the deceased had already applied for and purchased multiple policies but failed to declare these existing and pending applications. There is no reasonable way he could have “forgotten” about them. The court found that this was not just non-disclosure, but fraudulent non-disclosure which is a deliberate attempt to hide critical information.

Another reason for the policy to be void was due to Misrepresentation.

Misrepresentation involves providing false or misleading information on an insurance application. This can be intentional or unintentional, but the consequences can be equally serious. When an applicant answers questions incorrectly, whether deliberately or through carelessness, they are misrepresenting facts to the insurer.

In the case, the deceased answered “no” to questions about whether he was applying for other policies or had policies pending approval. This was clearly untrue. He had multiple applications in progress at the same time. Because insurers rely on these answers to make underwriting decisions, such false statements undermine the very foundation of the insurance contract.

The court noted that if full disclosure had been made, the S$1 million policy application would have been rejected outright as the total sum assured will exceed the maximum limit approved by the insurance company based on the life assured’s income. Since the policy was obtained through fraudulent non-disclosure and misrepresentation, the insurer was legally entitled to void the policy, as if it had never existed.

This case highlighted several critical lessons about insurance applications:

- Answer All Questions Truthfully and Completely. Every question on an insurance application is there because it helps the insurer assess risk. Whether about existing policies, medical history, occupation, or lifestyle, each answer matters. If you’re unsure about how to answer a question, seek clarification from the insurer or a trusted advisor rather than guessing or providing incomplete information. When in doubt, disclose. It is always safer to explain more than to explain too little.

- Disclose All Existing and Pending Policies. Insurers need to know about your complete coverage picture. This helps them determine whether additional coverage is appropriate and ensures you’re not over-insured relative to your actual financial needs. In underwriting assessments, insurers must take into account existing policies and pending applications to make informed decisions.

- Work with Ethical Advisors. Choose insurance advisors who prioritize your long-term interests over short-term commissions. A good advisor will help you understand coverage limits, ensure you’re providing accurate information, and structure protection that genuinely serves your family’s needs rather than encouraging inappropriate over-insurance.