We had just passed the first weekend of 2026, still very much motivated with our financial resolutions. However, it happens every year. January rolls around, and we’re fired up with our goalsput i. We promise ourselves we’ll finally build that emergency fund, start investing properly, cut unnecessary expenses, and get our insurance sorted out. We make elaborate spreadsheets, download budgeting apps, and feel invincible.

Then February hits. Life gets busy. Work demands pile up. That emergency fund contribution? Skipped. The investment research? Still sitting in bookmarked tabs. By March, those ambitious resolutions have quietly faded into the background, replaced by the usual routine.

If this sounds familiar, you’re not alone. Research shows that less than 10% of people actually achieve their New Year’s resolutions. The problem isn’t a lack of good intentions. It’s that most of us approach financial goals the same way we approach crash diets: with unsustainable enthusiasm that burns out quickly.

The good news? Keeping your financial resolutions doesn’t require superhuman discipline. It requires smarter strategies. Here are five practical hacks that actually work.

Hack #1: Replace Your List with One “Keystone” Goal

Instead of juggling ten financial resolutions, identify one keystone goal that will create a domino effect. A keystone goal is powerful because achieving it naturally leads to progress in other areas.

For example, if you commit to “automate savings of $1,000 every month,” this single action forces you to budget better, reduce impulse spending, and become more conscious of your cash flow. Before you know it, you’re inadvertently achieving multiple financial objectives through one focused habit.

Think about which single financial change would make the biggest difference in your life this year, then pour your energy into that.

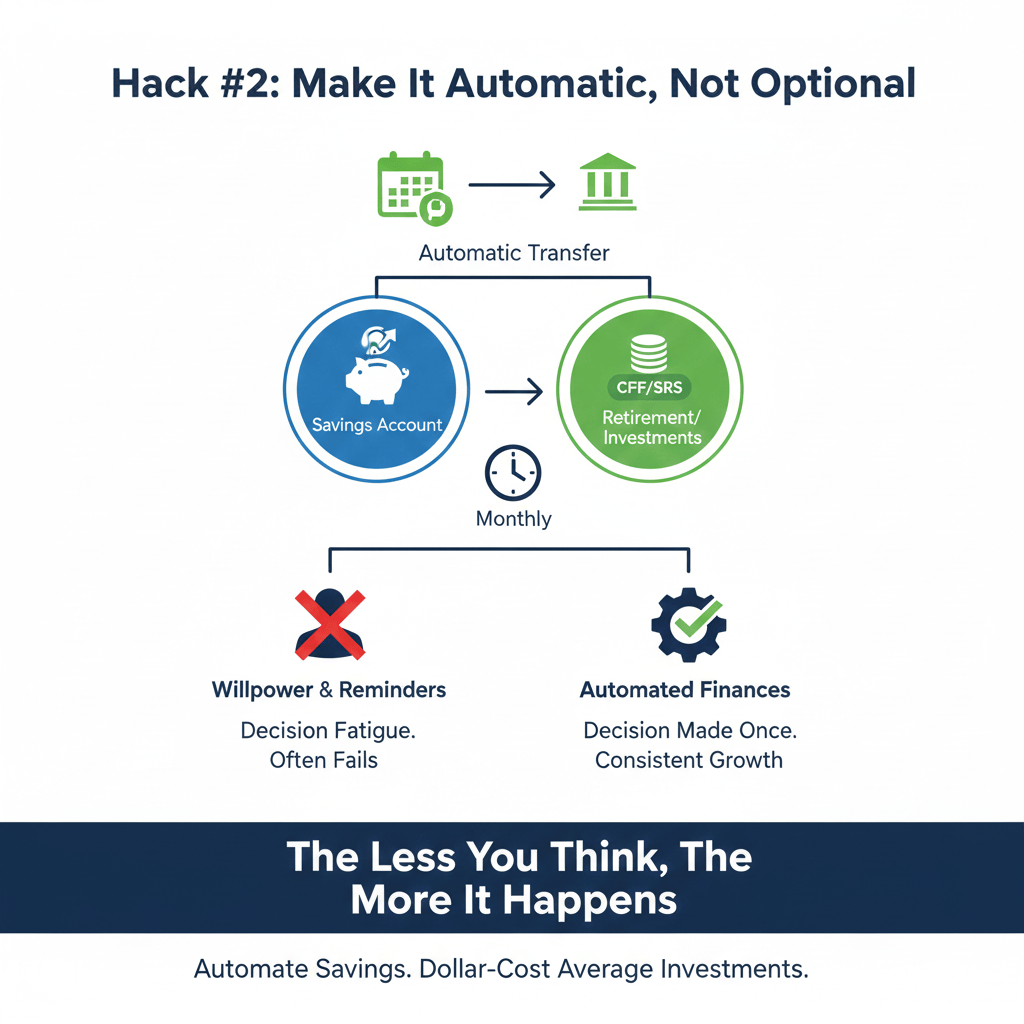

Hack #2: Make It Automatic, Not Optional

Willpower is overrated. The most successful savers and investors don’t rely on monthly reminders or self-discipline. They remove the decision entirely by automating their finances.

Set up automatic transfers to your savings account on payday. Arrange for CPF top-ups or SRS contributions to happen without you lifting a finger. Configure your investment platform to dollar-cost average every month. When the decision is made once and executed automatically, there’s no room for “I’ll do it next month.”

The less you have to think about it, the more likely it’ll actually happen.

Hack #3: Attach Finances to Existing Habits

Behavioral science shows that new habits stick better when linked to established routines. Instead of creating standalone financial tasks, piggyback them onto things you already do consistently.

Review your portfolio every time you have your monthly team meeting. Check your credit card spending when you do your weekly grocery run. Schedule your insurance review during your annual health checkup. By anchoring financial tasks to existing habits, they become part of your natural rhythm rather than additional burdens on your to-do list.

One example is my client who is a busy working mother who struggled to track her family’s expenses. Every month she promised herself she will sit down and review their spending, but it never happened.

Her breakthrough came when she linked it to her existing Sunday meal planning routine. Every Sunday evening, she already spent 20 minutes planning the week’s meals and making a grocery list. She simply added one step: open her banking app and quickly categorize the past week’s transactions as part of the planning routine.

This small addition took less than 5 minutes but gave her a weekly pulse on where money was going. Within two months, she identified that food delivery apps were costing her family over $400 monthly. She decided that money can be put to better uses instead. The habit stuck because it ride on something she was already committed to doing every single week.

Hack #4: Build in Accountability Checkpoints

Goals without accountability are just wishes. Most people abandon their financial resolutions because there’s no one checking in and no consequences for giving up.

Share your goals with someone who’ll actually hold you accountable. This could be a trusted friend, a financial advisor, or even a small accountability group. Schedule quarterly check-ins where you review progress honestly. Some people find success by making their goals semi-public, sharing updates with a close circle who’ll notice if things go quiet.

The simple act of knowing someone will ask “how’s that emergency fund coming along?” can be surprisingly motivating.

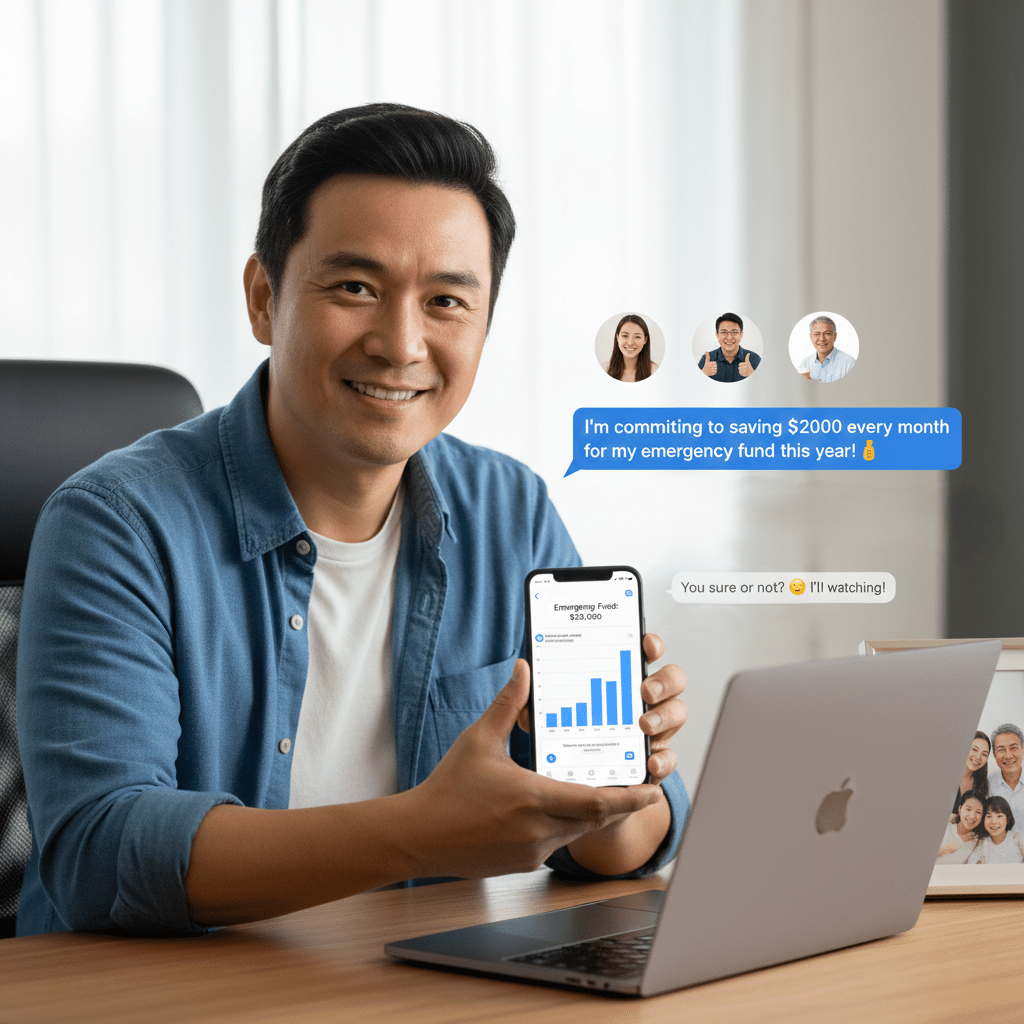

My client had been trying to build a $100,000 savings for three years with little progress. He will save for a month or two, then gradually slide back into old spending habits. No one knew about his goal, so no one noticed when he gave up. I knew about it cos we did a financial review every year and I realised it was a wish than a goal.

Last January, we sat down for a discussion and he agreed to do something different. He texted three close friends(including me): “I’m committing to saving $2,000 every month this year for my emergency fund. I’m sharing this with you because I need accountability. Can we do a quick check-in call on the last Friday of every month? Just 5 minutes. I’ll share my progress, and you guys can remind me if I’m not on target.”

Some months the calls were great ones! He saved more than his targeted amount. Other months, when he tried to explain why he had only saved $1,200, then we do a quick check in and see how to prevent that over-spending. His friends will make jokes out of it…Throw simple challenges like “You sure or not?” That gentle pressure made all the difference.

By December, he had accumulated almost $28,000. He had accumulated than the previous three years combined. The game-changer wasn’t willpower or financial knowledge. It was knowing that three people he respected would ask him, “So, how did you do this month?” The accountability transformed a wish into a commitment.

Hack #5: Reward Progress, Not Just Perfection

Here’s where most financial resolutions fail. We set rigid, all-or-nothing standards. We quit when we miss our target or miss one month of investing.

This perfectionist mindset kills momentum. Instead, celebrate incremental progress. Remember the client mentioned in Hack #4? At certain months, he saved $1,200 instead of $2,000? That’s still $1,200 he didn’t have before. Late is better than never. Less is better than nil. You still started.

Build in small rewards for hitting milestones. Reached your first $5,000, $10,000 etc in emergency savings? Treat yourself to a nice dinner and sometimes, I shared that we can use 1-5% of the milestone amount to reward yourself in a simple way. When progress feels rewarding rather than restrictive, you’re far more likely to keep going.

The Bottom Line

The problem with most financial resolutions isn’t the goals themselves. It’s the execution strategy. By focusing on one keystone goal, automating decisions, linking finances to existing habits, building accountability, and rewarding progress, you transform vague wishes into sustainable systems.

This is perhaps where an adviser adds the most value. Beyond product recommendations and portfolio management, a good financial adviser serves as your dedicated accountability partner. They’ll send reminders when you drift off course, celebrate your wins when you hit milestones, and provide course corrections when life throws curveballs. Many clients admit they value the accountability even more than the financial expertise because accountability is what transforms knowledge into action.

This year, don’t just make resolutions. Make them stick.

What financial goal will you commit to this year? And more importantly, which of these hacks will you use to make sure you’re still working on it come December?