Insurance is meant to give us peace of mind. Unfortunately, scammers are getting smarter at creating fake “insurance policies” to trick people into paying money or sharing sensitive information. It was reported there were almost 800 cases in first half of 2025 resulting in more than $21 million lost to insurance scams. A few of my clients had also encountered such scams and thankfully none fell for them. In the latest incident last Sunday, a client called me after receiving a suspicious message with a fake insurance document. Upon checking, I confirmed it was a scam and advised him on the next steps.

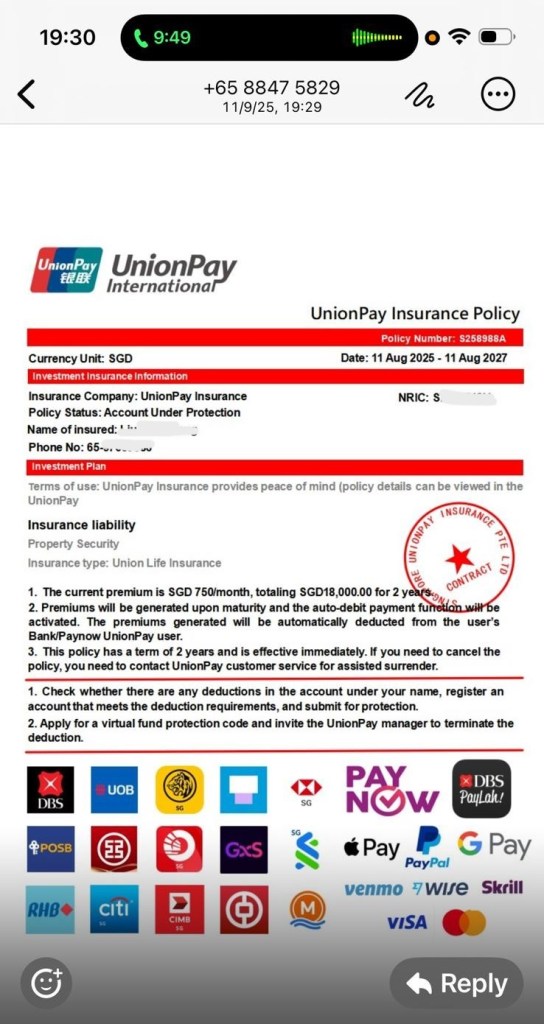

These scams cases usually have scammers send fake insurance documents complete with official-looking logos, policy numbers, and even red company stamps that look very convincing These tactics are designed to create urgency and push victims into making payments without verifying the source.

Here are some red flags to watch out:

🚩Poor formatting and language

- Look out for awkward grammar, vague terms, or phrases like “account under protection” and “apply for a virtual fund protection code” are awkward and unprofessional. These phrases are common in scams but unusual in real insurance contracts.

🚩Pressure tactics

- Scammers create a sense of urgency: “Apply now,” “avoid deduction,” “immediately effective.”

🚩Suspicious Methods of contact or payment

- Requests to call unknown numbers, use WhatsApp, or transfer money via less commonly used payment methods like UnionPay, Skrill, or cryptocurrency.

🚩Overuse of Logos

- Genuine insurers don’t plaster random bank and payment logos all over their policy documents.

🚩Fake-looking stamp

- The red circular stamp “UNIONPAY INSURANCE PTE LTD” is not an official regulator-approved stamp.

If you want to verify the authenticity of the messages, you can do the following to verify the source.

✅Check MAS website

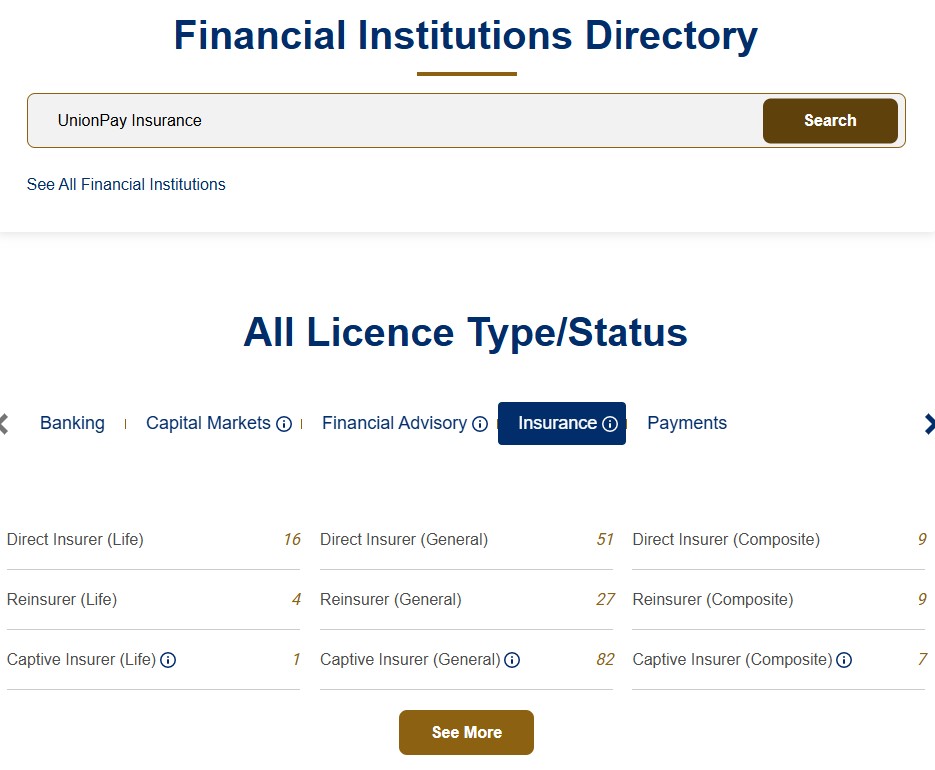

- Go to MAS Financial Institutions Directory: https://eservices.mas.gov.sg/fid.

- If the company is legitimate, it will be listed. For example, “UnionPay Insurance” is not listed and therefore not a licensed insurer.

✅Call the official hotline

- If you want to call the insurer to verify, use the number listed on the MAS directory or insurer’s website.

- Do not use the number provided in the message.

✅Check with your trusted financial advisor representatives.

- Call your trusted financial advisor representatives to check with them to confirm if the information is genuine or a scam.

What To Do If You Receive Such a Message

🚨Do not provide any personal or financial details

🚨Do not click on links

🚨Report the number to:

- ScamShield (1799)

- Singapore Police Force Anti-Scam Centre (1800-722-6688)

Insurance should protect you, not put you at risk. Stay alert, verify before you act, and always consult a trusted adviser if you are unsure.