Singapore’s property market has seen significant transformation over the past two decades. From humble HDB flats to private condominiums and landed homes, the appreciation in home values has shaped the wealth trajectory of many Singaporeans. At the same time, equity markets—most notably the Straits Times Index (STI)—have offered another path to long-term financial growth.

In this blog, we compare how different asset classes—4-room and 5-room HDB flats, Executive Condominiums (ECs), private condos, landed properties, and the STI—have performed from 2005 to 2025.

Before I continue, I need to inform you that I am not a licensed real estate agent and the numbers are sourced from HDB & URA Price Index and SPDR STI ETF. For discussion purpose, we are looking at getting a property for investment purpose. We are using STI for comparison since we are looking at local property so we can reduce the effects of geopolitical, currency and country risk. Next, the time horizon for holding to the property or investment is 20 year. You may be asking, “Why 20 years?” It is because :

- Reflects Realistic Long-Term Investment Behavior

- It captures Full Market Cycles to go through booms, busts, and recoveries.

- Smooths Out Short-Term Noise

- Anchors Mindset for Financial Planning

An Average 4‑room resale price is about S$250k in the 2005. If we had sold it today, it will be in the range of S$550–660 k. We see an appreciate of estimated 164% gain. Do note the prices peaked in 2013, dipped till 2019, then rebounded sharply till today. For a 5-room flat, the gain is similar at about 160%.

It is interesting to see while it cost much more to purchase an Executive Condominiums (ECs), private condos or landed properties which in turn allow us to sell at a much higher price, the total gain is quite similar to the 4- & 5-room HDB flats in the range of 150% to 160%.

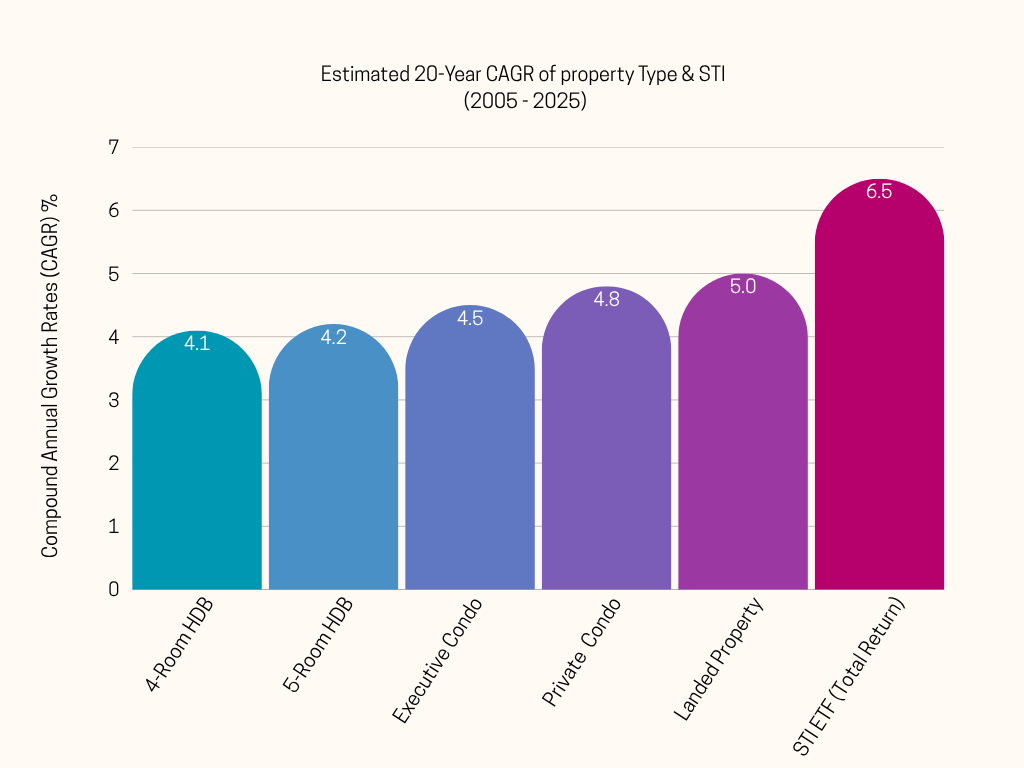

What about STI? To be honest, the result surprised me as well. The gain was a whooping 230% in the same period! Below shows the Compound Annual Growth Rate(CAGR) of the different property types and the STI.

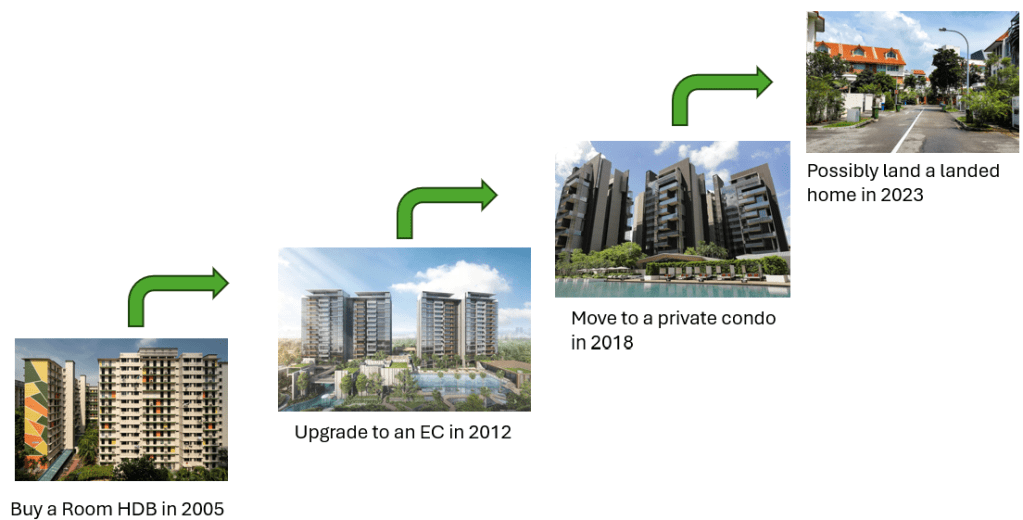

An investor will unlikely hold an investment property for 20 years. They will usually practicing asset progression—moving from one property type to another which can significantly amplify ROI compared to just holding a single property. Asset progression can be achieved by upgrading to higher-value properties over time, often using capital appreciation from your current home as a stepping stone. A typical path might look like

This approach compounds your equity, allowing you to leverage earlier gains to enter more lucrative segments. The CAGR over 20 years with asset progression is about 8–9% annually compared to the average 4-5% as seen previously. If well-executed, asset progression can double your ROI compared to holding a single flat. It’s a powerful, proven wealth strategy in Singapore—but it requires planning, timing, and sometimes professional guidance. But in reality, it is challenging to keep upgrade our property without taking a loan. And in Singapore, there are certain restriction such as loan restrictions (TDSR/MSR limits), Stamp Duties or Additional Buyer Stamp Duty(ABSD). The true ROI of a property reflects the ROI after accounting for key cost. For example, we bough a 4-room HDB in 2005 for S$250k and sold it at S$660k in 2025

There’s a 20-year HDB loan @ 2.6% and the following cost

- BSD, legal fees, and renovation (~S$30k total)

- Monthly loan repayment: ~S$1,133

- Interest paid over 20 years: ~S$68,000

- Misc. maintenance, taxes: ~S$15,000 total

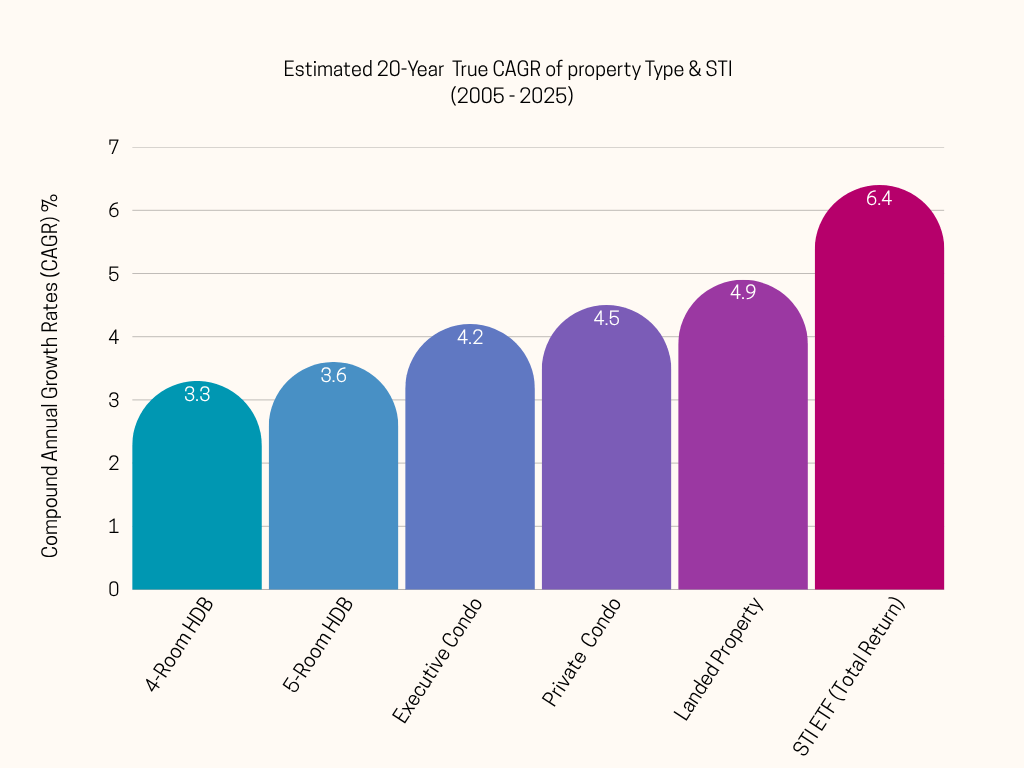

True ROI = ~118% over 20 years(previously was about 164%) and CAGR drops from ~4.1% to ~3.2–3.5%

The chart below shows the True CAGR.

The net ROI picture is very different from raw appreciation numbers. The costs involved in property can erode 0.5–1.5% annually from your returns especially when factoring in interest and transaction costs.

As we’ve seen, both property and equities have delivered substantial returns over the past 20 years in Singapore. While HDB flats offer stability, private properties provide potential for higher returns, especially when using strategies like asset progression. Meanwhile, the STI or other investments —often overlooked—has outperformed most residential property types when dividends are reinvested and costs are low. The truth is there is no single “best” investment instrument.

The right choice depends on:

- 🏦 Your financial capacity (e.g. can you service loans or afford ABSD?)

- 🎯 Your investment objective (e.g. are you aiming for growth, income, or security?)

- ⚖️ Your risk appetite (e.g. can you handle market volatility or prefer tangible assets?)

Property requires more capital, time, and ongoing management—but can be a powerful tool when used strategically. Stocks, on the other hand, offer lower friction, more liquidity, and clean compounding over time.

Before making any decision, it’s best to speak with a licensed financial adviser or property professional. A well-aligned strategy will help you make confident, informed moves—whether you’re buying your first home, investing for retirement, or planning your next asset upgrade.

📌 Invest wisely—not just widely.