Recently, a contact from social media asked if we can do a session to educate the public what situation is claimable and what’s not in a “Fire Insurance”. In general, fire insurance can broadly classified into commercial or residential properties. A commercial fire insurance will be meant for offices, shophouses, warehouses or even a factory. The type of coverage differs from each type of commercial property and it’s use. This article shall focus on fire insurance for residential property and we shall refer to them as Home Content Insurance. A residential property can be from our HDB flats to private Condominium and landed property.

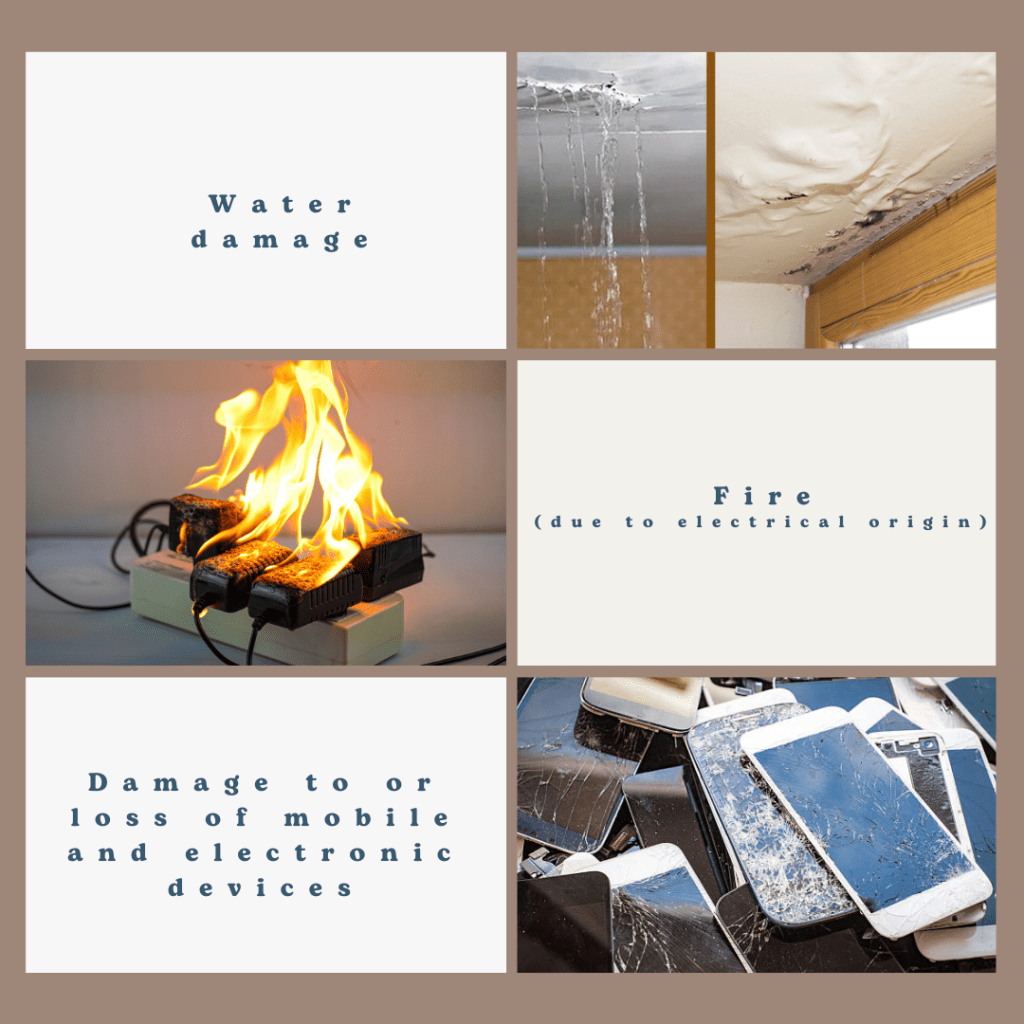

Home content insurance is a type of coverage that protects your personal belongings within your home. It provides coverage for loss or damage to your possessions due to a wide range of perils, such as theft, fire, water damage and more. Perils, in the context of insurance, refer to the specific events or circumstances that can cause damage, destruction, or loss to your property or possessions. In layman term, perils refers to the cause that results in a claim. It was reported by one of our partners, Chubb, the top 3 claims received were as below.

It is almost impossible to give all the possible scenario that could result in a home content insurance claim but we can learn to understand the two different types of home content insurance so we can avoid a rejected claim.

The first reason is our home content insurance covers ‘Insured Perils’. These policies will list the covered events and items. The followings are the insured perils that are commonly covered by insurers:

• Fire

• Lightning

• Explosion

• Impact by road vehicles

• Bursting or overflowing of water tanks or pipes

• Theft by violent or forcible entry

• Specified natural disasters such as floods, windstorms, earthquakes and volcanic eruptions

• Riots and strikes

Any loss or damage that is not caused by the perils listed is not covered.

If we do not wish to be restricted by the perils, we can purchase an ‘all risks’ policy. Just to clarify, an all risk policy does not mean that it covers everything. The difference between a peril and all risk policy is a peril policy will cover only if the event is listed. However, for an all risk policy, it will not cover any event that is listed in the exclusion list. A sample of an general exclusion list is shown below. In each event, there maybe more specific exclusion stated in the policy wordings and do note the exclusion may differs between insurers.

So, the second reason that a claim was rejected could be due to an excluded event.

To cite a claim example between the two policies, if we left our keys on the lock and a person use it to enter our house to steal our things. In an insured perils policy, this claim will be rejected because it only covers

- Theft by violent or forcible entry

In this case, there was no violent or forcible entry such as damaged door or locks, thus not claimable.

However, an all-risk benefit policy will pay because the event is not in the exclusion list unless there are reasons which insurers think it should not be paid.

Lastly, the third reason for claims to be rejected is when it involves an illegal act or an activity not approve by the authorities.

For example

Using electrical plugs or electrical appliances without the Safety Mark.

Illegal or non-approved works in HDB flats.

Now that we have understand the common situations that results in a rejected claim, you may want to understand the amount we need to cover for our property and contents.

1 Comment