I went for a design thinking program a few years ago. While this seems to be a very ‘engineering’ process, it can also help in the daily work for financial planning. First, let us understand what is Design Thinking.

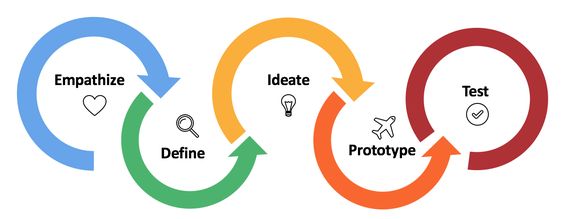

Design thinking is a non-linear, iterative process that teams use to understand users, challenge assumptions, redefine problems and create innovative solutions to prototype and test.

(Source: Interaction Design Foundation)

In Harvard Business School, it states “Design thinking is a mindset and approach to problem-solving and innovation anchored around human-centered design.”

The key word in Design Thinking is ‘User-Centric’. As a product designer, are we designing it because we like it this way or because the end-user prefers it that way? One example is while using an phone app or website for the first time, how often you find the system silly such as the way the light font colors blend with the white background making it hard to read? Or you wish an icon is placed somewhere more prominent? Those bad designs are most probably done without user-centric in mind.

There are 5 steps in the design thinking process.

So, how can these process help in financial planning?

Applying design thinking principles to financial planning can help us create innovative and user-centered solutions that better meet the needs of individuals. It also tailored to the specific needs and goals of the individuals.

- Empathize: We need to understand the needs and goals of the individuals we are working with. We can know the financial goals of an individual easily. All we need to do is ask and the individual may just tell us his financial goal is to retire with $1mil at 55 years old. As a financial planner, it helps to understand the “Think and Feel” behind his goal. E.g. why does he feel retire at 55 is the right age and not at 50 or 60? What are his plans at 55 and so on… As a financial planner, we can ask questions or through observations to gain deep insights into their financial challenges, aspirations, and preferences. This step is crucial for developing a user-centered approach.

- Define: We have to highlight clearly the financial issues and opportunities that need to be addressed. This allows all parties to have a clear and common goal. For example, it could be helping individuals plan for retirement or optimize investment strategies.

- Ideate: As a financial planner, I encourage brainstorming sessions between the client and myself to generate a wide range of ideas for addressing the defined problem. It may be necessary to involve other parties, such as estate planners or even their family members. We want quantity over quality during this phase and explore creative possibilities without judgment. This way is better than to suggest to the client that we should invest or get a retirement product from insurance for their retirement.

- Prototype: We select the few preferred solutions from the ideation phase and create some “prototypes” or simulations of potential solutions. This can be done by illustrating using the benefit illustrations of an insurance plan or the historical returns of an investment to look at the worst or best case scenario or to manage the individual’s concern. The goal is to quickly visualize and test concepts without investing significant resources. E.g. Client may be concern what if he gets retrenched after getting the investment plan.

- Test: We gather feedback from the clients by presenting the solutions. We observe their reactions and listen to their suggestions. This iterative feedback loop helps refine the solution and validate their effectiveness in addressing the defined financial challenges. This can help to affirm the person’s attitude, behaviour and action commitment to his financial goals.

These following steps are not in the design thinking process but from the financial planning process, we have-

6. Implement: Once we had refined and validated the solution through (back)testing, it’s time to develop the final solution. In simple term, this is the closing and putting the solution in place.

7. Evaluate: We continuously assess the effectiveness of the implemented solution and gather feedback from clients. This step is important as it allows us to assess whether our solution is achieving the desired goals. As client’s situation may had changed over the years, we also use this step to make further improvements and enhancements as necessary.

So, design thinking in financial planning allow us to

- understand the client’s goals better

- brainstorm for solution

- handle client’s concern/worries

before a insurance or investment plan is taken up. How can we improve on the process?