The properties in Singapore are purchase with two types of ownership if there are more than one owner . The property will be either under joint tenancy or tenancy-in-common.

In a joint tenancy, the owners have equal share of the property. The ownership of the property will be automatically passed on to the surviving co-owners regardless if a Will was made. Most HDB properties are under this arrangement.

Another type of ownership i.e. Tenancy-in-common allows each owner to have a different share of the property and to leave his share of the property to any beneficiary upon his death. The beneficiary may receive his share in equal or different percentage. This type of ownership usually occurs in private properties and in certain situation, it can be for HDB flats, depending on the scheme that the flat is purchased.

In the above example, the Husband can Will his share of 35% to the wife, son and daughter at 20%, 10% and 5% respectively. Therefore, the total share among them will be wife (45%), Son ( 20%) and daughter (35%). This distribution can cause an issue such as the wife even though holds the majority of the share at 45% but the total holdings of the children is 55%. If the children decides to sell this property, the wife can only agree to it.

We will discuss about the distribution issues in future and for now, there is a bigger problem with property ownership with outstanding loan. In the above situation, regardless of Joint Tenancy and Tenancy-in-common, if a mortgage insurance (or more commonly known as Home Protection Scheme for HDB) is not in place to cover the husband’s share, the beneficiaries will continue with the loan. If this property has an outstanding loan of $1mil, this amount will be re-structure with the surviving owner’s financial ability to loan base on their Total Debt Servicing Ratio(TDSR) . What this means is there can be a possibilty that the bank will not approve the same $1mil outstanding loan to the new owners due to a lower TDSR because of lower income. The owners will have to pay up $200,000 if the approved loan is at only $800,000. In the worse case scenario, the new owners may have to force-sale the property instead of inheriting it.

The most cost effective way to cover the outstanding loan is to have a mortgage insurance. Typically, an owner can have an individual policy to cover or a joint-life mortgage insurance to cover the first death of the owners.

Assuming a couple took an individual policy to cover their $1mil outstanding loan, the mortgage may look like this.

The total premiums will be $5555.55

In the event if the husband passes on, the $1mil will be paid out to the family so that they can offset the loan. The surviving owner can choose to terminate or continue with her own policy. If both pass on (e.g in a traffic accident), a total of $2mil will be paid.

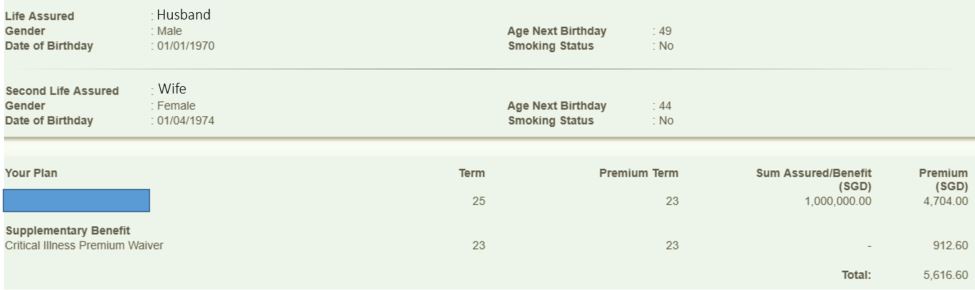

Alternative, some will choose to use a joint-life mortgage insurance and the couple will buy a $1mil policy to cover the first death of the owner. Will this be cheaper or more expensive?

Here’s an example

In the event if the husband passes on, the $1mil will be paid out to the family so that they can offset the loan and the policy will be terminated. The premium is $5616.60

Which is a better option depends on individual’s situation. It is uncommon the total premium of 2 individual policies cost more than a joint-life policy. Do talk to your financial adviser to have a proper assessment of your risk. Our intention of purchasing a property is always to pass down an asset, do not leave behind unsettled debt.