Choosing a career as an Independent Financial Adviser (IFA) is not just about numbers, charts, and investment returns. It’s about people—their aspirations, families, and dreams for the future. At Avallis, we believe financial advice should be independent, client-focused, and guided by professionalism. Since our founding in 1997, we’ve helped thousands of individuals and families achieve their financial goals through trusted, unbiased advice.

Now, we’re looking for motivated individuals to join us on this journey as Independent Financial Advisers (IFAs).

Why Join Avallis as an IFA?

- Independence with Integrity

As an Avallis adviser, you are not tied to any single product provider. You’ll have access to a wide range of insurers, investment houses, and financial institutions—giving you the freedom to recommend what truly fits your clients’ needs. - Flexibility of Time

We understand the value of work-life balance. At Avallis, you design your own schedule for meeting clients, building your practice, and making time for what matters most in your life. - Attractive Income Potential

Your earnings reflect your effort, relationships, and expertise—not a fixed salary. - Personal Coaching and Mentorship

You’ll be guided by seasoned Avallis advisers who share their experience generously. Beyond that, our leadership includes a Certified Financial Planner (CFP) lecturer, ensuring you benefit from both practical mentorship and structured professional training. This unique blend accelerates your development and sets you apart in the industry. - A Trusted Brand

Avallis has built a strong reputation in Singapore for professionalism, independence, and long-term client relationships. Joining us means being part of a culture where advice is respected, and advisers are supported.

Why Consider Becoming an IFA?

- Empathy and Listening: Understanding not just financial goals, but personal stories.

- Technical Competence: Mastering areas like investment, insurance, retirement planning, and taxation.

- Communication: Explaining complex concepts in a clear, relatable way.

- Resilience: The IFA journey requires persistence, whether in building your client base or navigating market cycles.

Income Potential

One of the strongest attractions of becoming an IFA is the uncapped earning potential, coupled with the freedom of flexible working hours. Unlike salaried roles, your income reflects the value you bring and the client relationships you build.

Your income scales as your reputation, network, and expertise grow. Simply put—the more value you provide to clients, the greater your rewards.

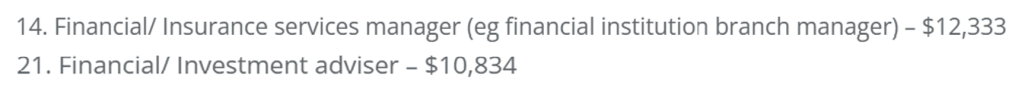

Top 10 Jobs (Source: Salary.sg)

The Impact You Make

At the heart of it, IFAs make a difference in people’s lives. Whether it’s:

- Helping a young family secure protection,

- Guiding someone through retirement income planning, or

- Supporting a business owner with succession strategies,

…your advice has long-term consequences that matter far beyond financial returns.

The Avallis Difference

A career as an Independent Financial Adviser can be both challenging and rewarding. You’ll need to balance continuous learning, compliance, and business development. But at Avallis, you won’t walk alone—we equip you with the tools, guidance, and community you need to succeed.

Ready to Explore the Career?

If you’re looking for a career that combines independence, flexibility, meaningful impact, attractive income potential, and personalised mentorship from experienced advisers and CFP educators, Avallis is the right place to grow.

We are currently inviting motivated individuals for a one-to-one career interview. Whether you’re new to financial services or considering a switch, this is your opportunity to discover how Avallis can help you build a rewarding and impactful career.

📩 Arrange an interview today or drop us a message.