How much will you be willing to lend me if I were to ask you for a loan today?

Your answer may depend on a few factors. For e.g. my credibility, my income and amongst other considerations, one of the most important factor will be what are your debt recovery options if I defaulted on the loan.

Similarly, if we were to ask for mortgage from a bank, they will conduct a risk assessment on the lenders before approving the loan. This loan amount as a percentage of the property’s value is known as the Loan-To-Value (LTV). The maximum LTV approved by Monetary Authority of Singapore (MAS) is 75% for Bank Loans and 85% for HDB Loans.

Assuming a buyer purchased a property worth $1 million and has a LTV of 75%. The downpayment will be S$250,000 (25% of $1mil). Out of this amount, S$50,000 (5% of $1mil) must be in cash and the remaining can be made in cash and/or CPF funds. The maximum loan amount obtainable is $750,000. The LTV can be as low as 15% depending on number of property owned and age of the borrower.

In another words, when we have a 75% LTV, we collateralize that amount to the bank which can be seized by the banks to offset the loss if we defaulted on the loan. The value of property, like any investments, can increase or decrease in value. As far as the bank is concern, they are willing to loan the borrower up to the LTV amount because that is the value that is recoverable by the bank if there is a default. In the case of a $1 million property, it will be $750,000. So, what happens if the value of the property drops below this amount? In this instance, the bank will exercise a margin call.

A margin call happens when the bank demands a top up of your loan. Two possible scenarios that will trigger a margin call are

- The value of your property is below your outstanding home loan.

- The value of your property is below your LTV.

Assuming the valuation of a $1million property drops by 35%, it will be valuated only at $650,000. However, remember that the bank is only willing to lend the amount of $750,000 based on a 75% LTV. Thus, the bank will demand a top up of $100,000. It may take a depreciation of 25% or more for a bank to trigger a margin call based on a 75% LTV and you may be thinking if that will ever happen.

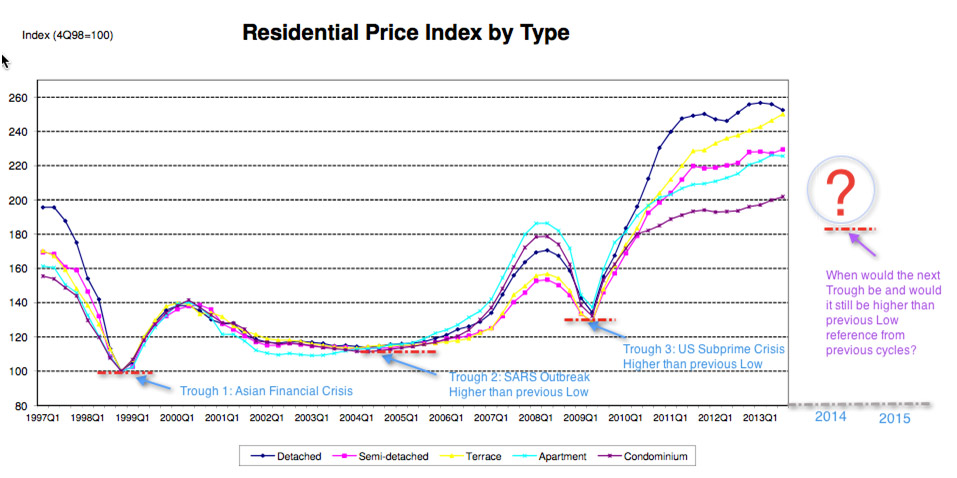

It was the Asia Financial Crisis when I first started the journey as a financial adviser in 1998. I remember the property market fell closed to 40% within a year. A recent article had reported an unit at Belle Vue Residences that was bought in 2012 was sold at a loss of $2.7mil. That translate to 36% loss over a period of 9½ years. In another report, a property in Sentosa Cove dropped 50%. We also need to understand the property market across different property class will be affected differently in the same market condition as shown in the chart below by CondoNewLaunches.sg

We are not saying property is a bad investment nor we should not invest in property but it is important to understand the risk in property investment is not only interest rate. Most property investors are able to manage the increased monthly installment due to increased in interest rates. There is also the option to re-finance if the installment is too much for the borrower. However, for the borrower to top up the loan which is usually a six figure amount, it may not be easy. We can avoid a financial pitfall like getting caught by a margin call due to property deprecation by talking to a financial planner to have a helicopter view of your cashflow. It is also important to understand the terms and condition in the loan agreement for e.g. what might trigger a margin call?